Which credit card is convenient for purchasing foreign hosting?

|

For overseas shopping, these three institutions are often used in the following situations: 1. Visa card is the most common, Paypal recommends binding V card 2. Master has collaborated with Amazon on promotions many times 3. AE cards can be successfully used on more American websites. The disadvantage is that currently only Bank of China, Industrial and Commercial Bank of China, CITIC Bank and China Merchants Bank can issue them, and the threshold is relatively high. (The CVC or verification code of AE card is the 4 digits above the card number on the front, and the CVC of V and M cards is the last 3 digits on the back) For specific instructions, please refer to the credit card information here. Next, let’s talk about which domestic credit cards support international currency settlement. Supporting international currency settlement requires a multi-currency credit card, so generally multi-currency credit cards support these credit card settlement institutions. China Merchants Bank <br /> The fees are not low. Even for gold cards, there are still fees for emergency reporting of loss and emergency replacement of cards abroad. There will be activities such as cash back for swiping US dollars, which is suitable for overseas shoppers advantage a. There are various card types and good services. You can apply for AE card, which is exempt from annual fee after swiping the card 6 times. b. Purchasing foreign exchange to repay is very convenient. It is particularly worth mentioning that as long as you deposit RMB into your CMB credit card, your USD balance will be automatically repaid first. This means you can use third parties such as Alipay, Tenpay, and 99Bill to repay your USD balance without having to purchase foreign exchange over the phone, which is more worry-free. shortcoming a. Currency conversion fee 1.5% b. The selling price of US dollar in 10 banks tends to move forward c. The overseas card-not-present transaction function cannot be turned off. China CITIC Bank Advantages <br /> You can purchase foreign currency automatically, apply for an AE card, and waive annual fees for 6 card swipes. The visa agency service is also good. There are many currencies, the selling price of US dollars is low, and the credit limit is strong. shortcoming a. Currency conversion fee 1.5% b. The overseas card-not-present payment function cannot be disabled c. The online banking function is relatively poor and the exchange rate cannot be checked. ICBC advantage a. It has the most outlets and a wide range of currencies. Unlike Bank of China, the foreign currency selling price is generally lower. You can directly purchase foreign exchange and repay in online banking, and the funds will be credited to your account in real time. b. There are AE cards and multi-currency cards, with no annual fee if you swipe the card 5 times, and no handling fee for withdrawing overpaid funds; the currency conversion fee (also known as the overseas transaction assessment fee) is low, 1% for V and 1.1% for M, the lowest among all domestic banks. Therefore, if you use a dollar card to pay for euros in Germany and repay in RMB, considering the appreciation of RMB, it may save you money on purchasing RMB than using a euro card. c. Repayment by purchasing foreign currency is more convenient. As long as you deposit enough money into your debit card, you can repay through automatic repayment or directly purchase foreign currency in online banking and the funds will be credited to your account in real time. This function is almost not provided by any bank. The online banking purchase of foreign currency repayment by CCB is not credited to your account in real time. Don't underestimate this function. It can save you money. You can refresh it continuously to find a low foreign currency selling price and then purchase foreign currency to repay the funds. You have great autonomy. In addition, you can choose to purchase foreign currency in real time through online banking (foreign currency consumption is converted into RMB in real time and accounts are recorded in RMB. Several years later, Bank of China's Global Card realized this function). d. The selling price of foreign currency is generally low. The foreign exchange rates of various banks are always slightly different. Although the differences between the rates of various banks are not large, ICBC's rate is generally lower, just a few points lower. However, if the amount is large, it can still save some money. e. You can easily enable or turn on the overseas card-not-present payment function to improve security. f. The interest-free period is 56 days. Although the billing date is always the 1st and the repayment date is always the 25th, it is the longest. The currency conversion fee is the lowest among all major banks, with V at 1% and M at 1.1%. shortcoming a. The credit limit may not be good. In the early years, applying for an ICBC credit card was harder than climbing to the sky. Even if you have very good financial strength, it is still difficult, especially for the Euro card, which is only 500 Euros. b. Service capabilities vary greatly among provinces. For example, my Euro card was refused once in Germany because the provincial card department said that there was no Euro card version, so I used the US dollar card version. As a result, the pre-printed bin did not match the embossed bin, and I was forced to use the US dollar card. c. Each card needs to be repaid separately, and the total consumption of all cards will not be automatically calculated. Industrial Bank advantage 1. A family member can apply for a standard dual-currency gold card with no annual fee for 5 card swipes and free SMS reminders; 2. The selling price of foreign currencies is generally low, and foreign exchange can be purchased automatically. Amazon earns points for US dollar consumption; 3. You can manually set the overseas transaction function: "close, one-time only, a certain period of time or permanently open"; (TXs who are concerned about network security can set "only once" before overseas shopping, and the overseas transaction function will be automatically closed after payment) 4. Purchase air tickets online and pay the full amount to receive a 20 yuan insurance policy. Disadvantages <br /> Few outlets. China Construction Bank <br /> It seems that there are no advantages and the disadvantages are not obvious. The selling price of US dollars is often higher than that of the other 9 banks, and the currency conversion fee is 1.5%. Bank of China <br /> Country and currency used (US dollar V, UK pound M, German euro V, Swiss euro V dollar V, Australian dollar V) advantage a. The highest level of internationalization. As the most professional foreign exchange bank in China, its overseas credit card business is the most mature. The design is mature and elegant. Most American cashiers know BOC, and there is no UnionPay plaster on the card. b. A full range of currencies. c. Bank of China has many overseas branches, making it convenient for you to go directly to the New York branch in the United States to pay off the US dollar balance on your US dollar card. Suitable for people going abroad for a long time. d. Real-time text messages. After paying with foreign currency, I will receive a call, but it will cost me international roaming charges. shortcoming a. The selling price of US dollars is not low and is often the highest. b. Annual fees are not waived for Euro or British Pound credit cards. If you are not going to Euro countries or the UK, don't apply for these cards because they are single-currency credit cards, are not free of annual fees, and when you swipe the cards domestically and keep accounts in foreign currency, you will also have to pay a 1.5% currency conversion fee. These annual fees can be used to offset many transactions with US dollar credit cards. c. Online banking sucks. Before 2008, I knew nothing about Bank of China's online banking. Online banking has been available since 2008, but the interface is clumsy and difficult to use. Credit card features are rarely customized. Single currency credit cards also need to be registered on another website in Hong Kong. d. Card-free payment on overseas websites cannot be disabled. In addition to the single foreign currency credit card that can register VBV, MasterCard Secure Code function, Bank of Communications <br /> Country and currency used (U.S. dollar M) advantage a. The selling price of US dollars is slightly lower than that of ICBC and the same as that of China Everbright Bank. Anyway, it won't be higher than Bank of China b. The Golden Phoenix card looks good. c. The credit limit is super awesome. shortcoming a. The currency conversion fee is as high as 1.95%. Why is it so high? The only other bank with the highest fee is Everbright. So never use it in non-US dollar areas. b. The overseas card-not-present payment function cannot be turned off, as some netizens have reported large-scale fraudulent transactions. c. Swipe the card quietly. There's no such thing as text messaging or anything like that, that costs money. China Minsheng Bank <br /> Country and currency used (U.S. dollar V) Advantages <br /> Very few Disadvantages <br /> Even for transactions in the same currency, a 1% so-called foreign transaction fee is charged. China Everbright Bank <br /> Country and currency used (U.S. dollar V-Fox card) advantage a. The selling price of US dollars is low, often the lowest among all 10 banks. Off topic: But its US dollar demand deposit interest rate is the highest, so all the US dollars are put aside. b. You can turn off the overseas card-not-present function by phone, but it is inconvenient to call every time. c. Real-time SMS notifications and frequent phone harassment, which wastes my international call charges. Disadvantages <br /> Currency conversion fee is as high as 1.95% Hua Xia Bank <br /> Country and currency used (U.S. dollar M) advantage a. The Deutsche Bank logo on the card is very familiar to many foreigners. On two occasions, American cashiers said: Your card is fantastic. I guess they saw the DB logo. b. You can turn off the overseas card swiping function. This function is different from closing the overseas card-not-present payment function. It is specifically designed for countries such as Malaysia, where card fraud is carried out by copying card information. It can be said to be a major feature. shortcoming a. The same currency still needs to charge a 1% so-called conversion fee b. Not as useful as Huaxia debit card. There is no service fee for overseas UnionPay cash withdrawals with Huaxia debit cards! ! ! Credit card experience 1. Daily use + bind PayPal to use CMB Visa, 2. For websites with strict card review, use CITIC AE. 3. Amazon launches Master promotion + global shopping with ICBC's Master multi-currency card. Precautions 1. Before applying for the card, ask whether you can purchase foreign exchange automatically (deposit RMB, and automatically purchase foreign exchange to convert to US dollars). Some banks (such as CCB V Card) require you to purchase foreign exchange by phone every time. 2. In addition to the currency conversion fee (which varies), some banks also charge overseas transaction fees. For example, Hua Xia charges a 1% handling fee for swiping US dollars, so use with caution! 3. Enable overseas use of your credit card. 4. Beware of online credit card fraud! via: https://plus.google.com/101168449375379418317 |

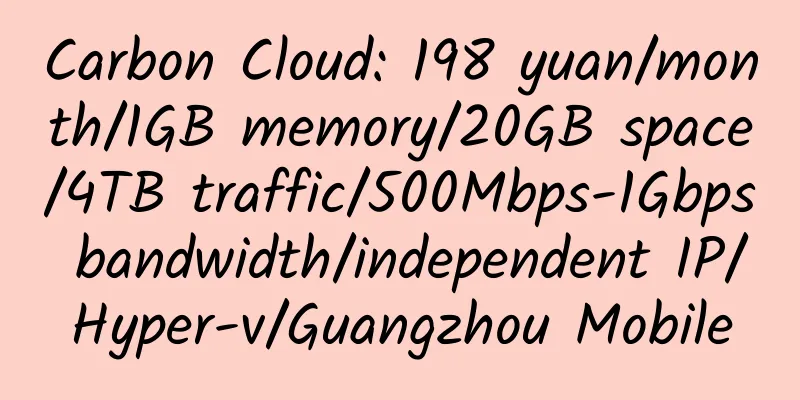

<<: INIZ: £12/year/128M memory/25G space/250G traffic/OpenVZ/VPS

>>: Daring Host latest 50% discount

Recommend

BandwagonHost: $61.65/half year/1GB memory/20GB SSD space/1TB traffic/2.5Gbps-10Gbps ports/KVM/Los Angeles CN2 GIA

BandwagonHost, an American hosting provider, has ...

freeavailabledomains.com provides free secondary domain names and supports DNS/NS/domain name forwarding

Freeavailabledomains is a foreign free domain nam...

WebHostFace: $2.07/month/15GB SSD/unlimited traffic/unlimited domain names/softlayer Singapore

WebHostFace, an American hosting provider, was es...

FlowVPS: $1.5/month/512MB memory/5GB space/200GB traffic/KVM/Australia

FlowVPS, a hosting service established by let mod...

A400: 19 yuan/month/1GB memory/20GB space/1TB traffic/30Mbps port/KVM/Los Angeles CN2 GIA

A400, a new merchant, mainly provides KVM VPS on ...

handyhost: 36 yuan/month/1GB memory/20GB SSD space/3TB traffic/KVM/Russia/Germany

handyhost, a Russian merchant, offers VPS, dedica...

Install Baidu Cloud Crawler on Centos 7

The crawler runs under MySQL, Python 2.7, and Mys...

Uovz: 599 yuan/month/2GB memory/20GB SSD hard disk/2TB traffic/100Mbps/KVM/Quanzhou CN2

Uovz, a stable Chinese merchant, has been introdu...

UnitxHost: $7/year/1GB SSD/unlimited traffic/unlimited domain names can be bound/United States

UnitxHost, a newly established hosting provider, ...

6 Months Free VPS from BudgetVM

I received an email from BudgetVM last night, off...

Partial VPS test information

Linode 0.357 sec 0.802 sec 0.023 sec 4 x Xeon L55...

Limewave: $3/month/1 core/1GB memory/20GB SSD space/1TB traffic/1Gbps port/2 IP/KVM/Canada

Limewave, a Canadian business, was founded in 201...

Buyvm: $3.5/month/1GB memory/20GB SSD space/unlimited traffic/KVM/Las Vegas CN2 GIA

Buyvm, a stable merchant, a good choice for websi...

Perfect Ping: $45/year/512MB RAM/20GB SSD/2TB bandwidth/OpenVZ/Los Angeles

Perfect Ping is an American hosting provider that...

CloudSilk: 26 yuan/month/512MB memory/10GB SSD hard disk/800GB traffic/2.5Gbps port/KVM/German BGP/China Unicom 4837/San Jose 9929

CloudSilk, a Chinese merchant, mainly provides KV...